In contrast, a larger spread suggests lower liquidity, as there are fewer investors willing to negotiate. Often, a smaller spread suggests higher liquidity, meaning more buyers and sellers in the market are willing to negotiate. The bid-ask spread can indicate a stock’s liquidity, which is how easy it is to buy and sell in the marketplace. The data displayed in the quote bar updates every 3 seconds allowing you to monitor prices in real-time. The bid size displays the total amount of desired shares to buy at that price, and the ask size is the number of shares offered for sale at that price. The numbers next to the bid/ask are the “ size”. amount that a seller is currently willing to sell. The bid is the highest amount that a buyer is currently willing to pay, whereas the ask is the lowest

To read Recharge’s recent exclusive interview with Plug CEO Andy Marsh - who has held his position since 2008 - click here.The bid & ask refers to the price that an investor is willing to buy or sell a stock. On top of this, it is also fast becoming a major green hydrogen developer, having recently signed a deal to supply online giant Amazon with more than 10,000 tonnes of renewable H2 annually from 2025, while in June it announced plans to build a 100MW green hydrogen production facility at the Belgian port of Antwerp-Bruges. Plug currently has a 1GW electrolyser and fuel-cell factory in Rochester, New York, is building a 2GW electrolyser plant in Queensland, Australia, in a joint venture with Fortescue Future Industries, and is also building a 1GW electrolyser factory in South Korea in a joint venture with SK Group. Recharge has approached Plug Power and Schubert Jonckheer & Kolbe for comment. “That does not mean that some findings will not go against the company or that payments won’t be made to the SEC and others for any incorrect statements made, but we feel that the potential of the markets it is in are so large and so long term that there will be little, if any, long term impacts on its business and its standing.” “The impact that Plug Power has had on the acceleration of the hydrogen business model is without peer, and we believe that it is likely, going on past class actions we have seen through, that both the company and its potential will remain untouched by this in the long term. These are not to be confused with deliberate falsehoods,” Peter White, CEO and principal analyst at UK-based analyst Rethink Energy tells Recharge. “In any company that relies heavily on sudden accelerations in business or falls in prices in order to achieve their future goals, there will be miscalculations.

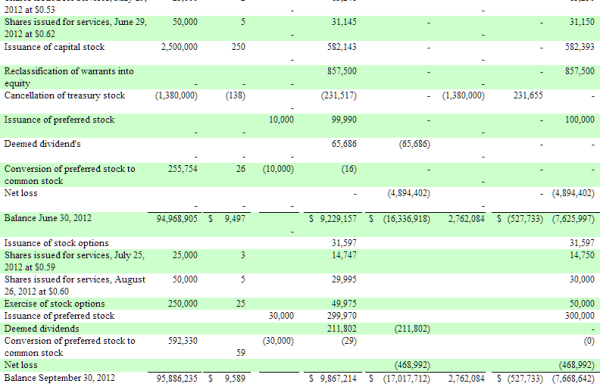

“The company also conducted two lucrative secondary offerings in November 2020 and February 2021, together netting approximately $3 billion of additional capital on the basis of these allegedly false and misleading statements.”įirst ever gigawatt-scale electrolyser order confirmed for offshore wind-powered green hydrogen project Middleton sold approximately $45 million of their personal holdings of Plug Power stock alongside several other high-level insiders, including at least six directors and the company’s General Counsel and COO.

At the same time, Plug Power also disclosed a material weakness in internal controls and announced that the company’s improper accounting practices, allegedly uncovered by a new auditor, dated back to 2016. “On May 14, 2021, the company restated several prior-period financial statements from 2018 through the third quarter of 2020 to address the misclassification. In a statement on its website, the legal firm writes: “Specifically, among other things, the company and its officers are alleged to have carried out a long-running scheme to misclassify the cost of liquid hydrogen delivered to customers, thus inflating the perceived profitability of Plug Power’s core business. EXCLUSIVE | ‘We’ll deliver 40 times as many hydrogen electrolysers in 2022 as we did last year’: Plug Power CEO

0 kommentar(er)

0 kommentar(er)